Articles

Momentive Performance Materials Inc. Announces Preliminary Third Quarter 2010 Results Oct 2010

October 21, 2010

ALBANY, N.Y., October 21, 2010 – Momentive Performance Materials Inc. (“Momentive Performance Materials” or the “Company”) today announced preliminary results for the third quarter ended September 26, 2010.

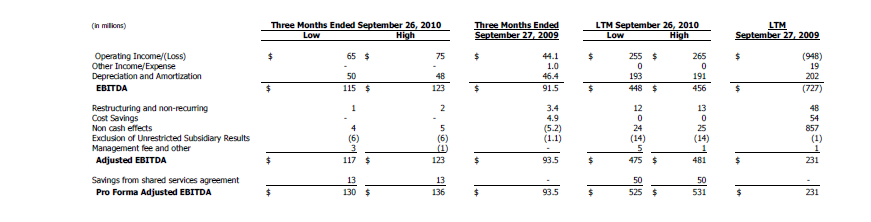

Momentive Performance Materials expects to post third quarter 2010 net sales of approximately $662 million, GAAP operating income of approximately $65 million to $75 million and Adjusted EBITDA of approximately $117 million to $123 million and Pro Forma Adjusted EBITDA of approximately $130 million to $136 million. In addition, the Company expects Adjusted EBITDA and Pro Forma Adjusted EBITDA for the twelve-month period ended September 26, 2010 to be between $475 million and $481 million and between $525 million and $531 million, respectively, which will represent a new record for the Company. Adjusted EBITDA and Pro Forma Adjusted EBITDA exclude the EBITDA of one of our subsidiaries that is designated as an Unrestricted Subsidiary under our debt documents of $6 million and $14 million for the quarter and twelve-month periods ended September 26, 2010, respectively. Pro Forma Adjusted EBITDA includes cost savings expected to be achieved under the shared services agreement that the Company recently entered into with Momentive Specialty Chemicals Inc. of $13 million and $50 million only for the quarter and twelve-month periods ended September 26, 2010, respectively. Last year in the third quarter, the Company recorded net sales of $568.4 million, GAAP operating income of $44.1 million, Adjusted EBITDA and Pro Forma Adjusted EBITDA of $93.5 million and Last Twelve Month Adjusted EBITDA and Pro Forma Adjusted EBITDA of $231 million. Last year’s Adjusted EBITDA and Pro Forma Adjusted EBITDA excludes the EBITDA of one of our subsidiaries that is designated as an Unrestricted Subsidiary under our debt documents of $1 million and $1 million for the quarter and twelve-month periods ended September 27, 2009, respectively.

Momentive Performance Materials also estimates that as of September 26, 2010 its total debt, net of cash and cash equivalents, will be between $2,645 million and $2,665 million, compared to $2,670 million as of the end of last quarter. The Company expects to be in compliance with all of the terms of the agreements governing its outstanding indebtedness, including the financial covenants, at the end of the third quarter of 2010. Momentive Performance Materials also announced today that it repaid $25 million of borrowings under its revolving credit facility in September 2010, leaving no borrowings outstanding under this facility.

“In the third quarter, we expect significantly higher sales and Adjusted EBITDA compared to the same period last year due to the recovery in our business and our cost initiatives during the recession,” said Craig O. Morrison, Chairman and CEO. He added, “Inflation in raw material costs, though somewhat offset by pricing actions, and inventory reductions from our planned second quarter build up, however, negatively impacted Adjusted EBITDA comparisons on a sequential basis.”

Momentive Performance Materials expects to file a more detailed press release regarding its third quarter 2010 results on Form 8-K as well as file its Form 10-Q for the three months ended September 26, 2010 in early November 2010, with an accompanying investor conference call to follow shortly thereafter.

Reconciliation of Financial Measures that Supplement GAAP

EBITDA consists of earnings before interest, taxes and depreciation and amortization. EBITDA is a measure commonly used in our industry and we present EBITDA to enhance your understanding of our operating performance. We use EBITDA as one criterion for evaluating our performance relative to that of our peers. We believe that EBITDA is an operating performance measure, and not a liquidity measure, that provides investors and analysts with a measure of operating results unaffected by differences in capital structures, capital investment cycles and ages of related assets among otherwise comparable companies. Adjusted EBITDA is defined as EBITDA further adjusted for unusual items and other pro forma adjustments permitted in calculating covenant compliance in the credit agreement governing our credit facilities and indentures governing the notes to test the permissibility of certain types of transactions. Adjusted EBITDA as presented in the table below corresponds to the definition of “EBITDA” calculated on a “Pro Forma Basis” used in the credit agreement and substantially conforms to the definition of “EBITDA” calculated on a pro forma basis used in the indentures. Adjusted EBITDA has important limitations as an analytical tool, and you should not consider it in isolation, or as a substitute for analysis of our results as reported under GAAP. For example, Adjusted EBITDA does not reflect: (a) our capital expenditures, future requirements for capital expenditures or contractual commitments; (b) changes in, or cash requirements for, our working capital needs; (c) the significant interest expenses, or the cash requirements necessary to service interest or principal payments, on our debt; (d) tax payments that represent a reduction in cash available to us; (e) any cash requirements for the assets being depreciated and amortized that may have to be replaced in the future; (f) management fees that may be paid to Apollo; or (g) the impact of earnings or charges resulting from matters that we and the lenders under our secured senior credit facility may not consider indicative of our ongoing operations. In particular, our definition of Adjusted EBITDA allows us to add back certain non-cash, non-operating or non-recurring charges that are deducted in calculating net income, even though these are expenses that may recur, vary greatly and are difficult to predict and can represent the effect of long-term strategies as opposed to short-term results. In addition, certain of these expenses can represent the reduction of cash that could be used for other corporate purposes. Further, as included in the calculation of Adjusted EBITDA below, the measure allows us to add estimated cost savings and operating synergies related to operational changes ranging from restructuring to acquisitions to dispositions as if such event occurred on the first day of the four consecutive fiscal quarter period ended on or before the occurrence of such event and/or exclude one-time transition expenditures that we anticipate we will need to incur to realize cost savings before such savings have occurred. Adjusted EBITDA and Pro Forma Adjusted EBITDA exclude the EBITDA of one of our subsidiaries that is designated as an Unrestricted Subsidiary under our debt documents. Pro Forma Adjusted EBITDA includes cost savings expected to be achieved under the shared services agreement that the Company recently entered into with Momentive Specialty Chemicals Inc. on October 1, 2010 only for the quarter and twelve-month periods ended September 26, 2010, respectively.

EBITDA, Adjusted EBITDA and Pro Forma Adjusted EBITDA are not measurements of financial performance under U.S. GAAP, and our EBITDA, Adjusted EBITDA and Pro Forma Adjusted EBITDA may not be comparable to similarly titled measures of other companies. You should not consider our EBITDA, Adjusted EBITDA or Pro Forma Adjusted EBITDA, which are non-GAAP financial measures, as an alternative to operating or net income, determined in accordance with U.S. GAAP, as an indicator of our operating performance, or as an alternative to cash flows from operating activities, determined in accordance with U.S. GAAP, as an indicator of our cash flows or as a measure of liquidity.

Forward-Looking and Cautionary Statements

Certain statements included in this press release constitute forward-looking statements within the meaning of and are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 under Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. In addition, our management may from time to time make oral forward-looking statements. All statements other than statements of historical facts are statements that could be forward-looking statements. Forward-looking statements may be identified by the words “believe,” “expect,” “anticipate,” “project,” “plan,” “estimate,” “will” or “intend” and similar words or expressions. These forward-looking statements reflect our current views with respect to future events and are based on currently available financial, economic and competitive data and our current business plans. Actual results could vary materially depending on risks and uncertainties that may affect our operations, markets, services, prices and other factors. Important factors that could cause actual results to differ materially from those in the forward-looking statements include, but are not limited to: our substantial leverage; limitations in operating our business contained in the documents governing our indebtedness, including the restrictive covenants contained therein; global economic conditions; difficulties with the integration process or realization of benefits in connection with the transactions with Momentive Specialty Chemicals Inc.; and our inability to achieve cost savings. For a more detailed discussion of these and other risk factors, see our Annual Report on Form 10-K for the fiscal year ended December 31, 2009 and our Quarterly Reports on Form 10-Q for the quarterly periods ended June 27, 2010 and March 28, 2010 filed with the Securities and Exchange Commission. All forward-looking statements are expressly qualified in their entirety by this cautionary notice. You are cautioned not to place undue reliance on any forward-looking statements, which speak only as of the date of this release. We undertake no obligation to publicly update or revise any forward-looking statement as a result of new information, future events or otherwise, except as otherwise required by law.

About the Company

Momentive Performance Materials Inc. is a global leader in silicones and advanced materials, with a 70-year heritage of being first to market with performance applications for major industries that support and improve everyday life. The Company delivers science-based solutions, by linking custom technology platforms to opportunities for customers. Momentive Performance Materials Inc. is an indirect wholly-owned subsidiary of Momentive Performance Materials Holdings LLC. Additional information is available at www.momentive.com.

About the new Momentive

Momentive Performance Materials Holdings LLC is the ultimate parent company of Momentive Performance Materials Inc. and Momentive Specialty Chemicals Inc. (collectively, the “new Momentive”). The new Momentive is a global leader in specialty chemicals and materials, with a broad range of advanced specialty products that help industrial and consumer companies support and improve everyday life. The company uses its technology portfolio to deliver tailored solutions to meet the diverse needs of its customers around the world. The new Momentive was formed in October 2010 through the combination of entities that indirectly owned Momentive Performance Materials Inc. and Hexion Specialty Chemicals Inc. The capital structures and legal entity structures of both Momentive Performance Materials Inc. and Momentive Specialty Chemicals Inc. (formerly known as Hexion Specialty Chemicals, Inc.), and their respective subsidiaries and direct parent companies, remain separate. Momentive Performance Materials Inc. and Momentive Specialty Chemicals Inc. file separate financial and other reports with the Securities and Exchange Commission. The new Momentive is controlled by investment funds affiliated with Apollo Global Management, LLC. Additional information about the new Momentive and its products is available at www.momentive.com and at www.hexion.com.

###

Contacts

Investors:

Peter Cholakis

(914) 784-4871

peter.cholakis@momentive.com

Media:

John Scharf

518-233-3893

john.scharf@momentive.com

New from Momentive

Momentive NXT Silanes: Delivering Sustainable Solutions

American Coatings Show 2024

April 30-May 02, 2024 | Indianapolis, Indiana, United States | Register

VIEW ALL TRADE SHOWS*The marks followed by an asterisk (*) are trademarks of Momentive Performance Materials Inc.